Today is the day for closing escrow on Soffit House. The Wife and I needed to produce $8,600 in the form of a cashier’s check to close on our house. So yesterday, I went to Wells Fargo to have that check drawn up, and was told by the perky 19-year-old teller that a cashier’s check was for amount in excess of $10,000, and that she could give me an official check instead which would be just as good.

Today is the day for closing escrow on Soffit House. The Wife and I needed to produce $8,600 in the form of a cashier’s check to close on our house. So yesterday, I went to Wells Fargo to have that check drawn up, and was told by the perky 19-year-old teller that a cashier’s check was for amount in excess of $10,000, and that she could give me an official check instead which would be just as good.

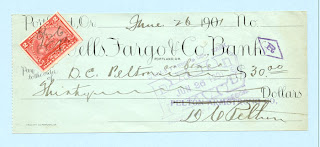

No, I said, it isn’t the same thing. Patiently, I explained the taxonomy of commercial paper to her. A cashier’s check is an instrument for which both the drawee and the drawer are the same party (in this case, Wells Fargo), and therefore is payable upon presentment. An official check is guaranteed by the bank, but it is not payable upon presentment as it is subject to Federal Reserve Regulation CC. (Well, okay, maybe I didn’t feel very patient inside as I explained this, but I did try to be polite while explaining myself.)

No, sir, the teller said, at Wells Fargo, the cashier’s check is for $10,000 and the official check is for less than that amount. Would you like to confirm that with my manager? Sure, of course you would.

Amazingly enough, the manager did confirm the teller’s statement and would not authorize issuance of a cashier’s check in the amount of $8,600. Perhaps she believed something she read on the internet. Needing to get back to court rather than continuing the argument, I took the official check, and the manager’s card,  and told her to expect a call from my escrow officer about the exact nature of the instrument that Wells Fargo had just sold me and whether it qualified for escrow.

and told her to expect a call from my escrow officer about the exact nature of the instrument that Wells Fargo had just sold me and whether it qualified for escrow.